When is the best time to raise funds?

Let me begin by saying that it is never easy to raise funds. The answer is the same for anything else in financing history - raise your Startup Funding when;

- You are highly confident that you are able to get much higher growth

- It is the sweet spot for trade-off in equity dilution

The reasons for the above are simple. When your growth rates are through the roof, Investors get excited and fight for the deal. They end up valuing you more to get the investment opportunity. Your revenue multiples go up in that case.

p/s if you are in Idea Stage, raising funds that early on can be extremely difficult. A good alternative is to join an accelerator program that is run by actual Investors and successful businessmen, which prepares you for exactly that.

How can we as Founders achieve the best time to raise funds?

To achieve a certainty in high growth, at Nexea we use a framework called the 3 Validation Step for Scaling your Startup. In short, it is to validate your;

- Market - If your potential revenues are less than RM100m, then you may have a problem listing later on. Let's say you are good and manage to capture 30% of your niche market - which would be RM30m. That would be the minimum amount to list on the stock market. If you had less, your chances of an exit would be too small and therefore creates an additional risk for VCs. This would deter them from investing in you, and therefore Angel Investors would also shy away.

- Product - People should love your product. They would have to need it so much that they are willing to pay for it - and ideally come back and pay for it again. Otherwise, it is a sign that your product might not be strong enough to sustain a high growth Startup.

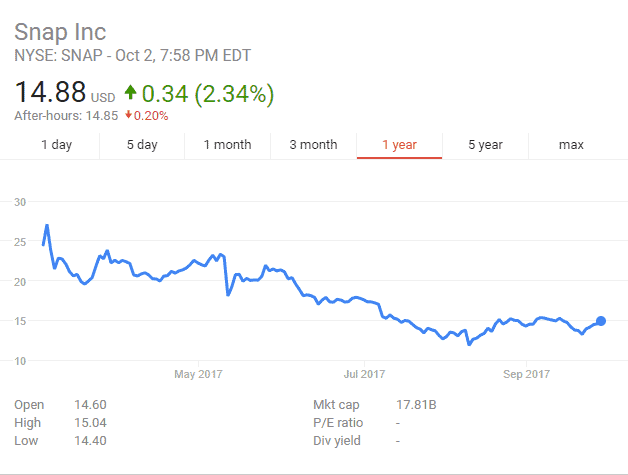

- Monetization - This is something even large Startups like Uber lacks - the ability to make a healthy gross profit. Well, at least for now. Scaling up without a clear monetization path is dangerous, as we can see with Snapchat:

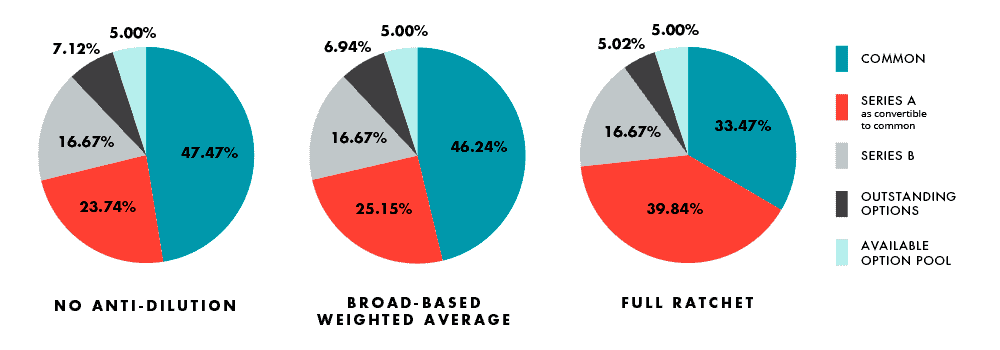

There are many more examples, but that is not the focus here. Realistically, most Startups would need healthy margins to maintain strong Investor confidence. This is for when your Startup gets listed on the stock market, later on, you would need to have the right margins to be able to support your Operating Expenses as well as to produce huge profitability. Otherwise, all that hard work building up your valuation can and will just disappear immediately. Check out this list of Startups where down-rounds have happened. Below is an example of the effect of down-rounds:

There are many more examples, but that is not the focus here. Realistically, most Startups would need healthy margins to maintain strong Investor confidence. This is for when your Startup gets listed on the stock market, later on, you would need to have the right margins to be able to support your Operating Expenses as well as to produce huge profitability. Otherwise, all that hard work building up your valuation can and will just disappear immediately. Check out this list of Startups where down-rounds have happened. Below is an example of the effect of down-rounds:

Once the above 3 validations steps are complete, you would usually be ready for growth. The market is large enough, people love your product, and they pay regularly to fix their pains. These are the foundations to a strong Startup.

When is the sweet spot for Startup equity dilution?

It's really the opposite of the above case of down-rounds. When everything is good and growth is high. You might not want to raise funds just before your growth starts to shoot up. Having some traction as proof for Investors to see the growth themselves would be highly convincing. That's when they see the money flowing in - and that's when they compete for your equity. That's when demand is more than supply and prices go up.

Less Controllable factors for when to raise funds for your Startup

- VCs have mandates and times where they tend to be more active and spend a little more. However, the effect is minimal.

- During a bubble - usually, every industry would have a bubble if the trend catches on. They don't last too long, so some Startups do take advantage of it. However, be aware that crazy valuations may not help long-term unless you are really able to deliver the results. The effects are detrimental if you are not.

- Sometimes, when the market is quiet and times are bad. This is the opportunity for stronger startups to get stronger, and the weak get weaker. Get funding to hire the best talent in the market from the weaker Startups.

Tips for when you raise funds

- Keep investor relations warm. This is hard work, but never cut off relations with Investors. They are always almost ready to talk again when conditions are right. So keep the relationship warm, and try not to cut it off. Sometimes, Investors are not interested just because Startups may not be ready or because of misjudgement.

- Keep improving that pitch deck as you go along, and ask for feedback always! Too often, as an Investor, we cannot give feedback at the risk of appearing too negative or disinterested. However, we always have pointers and are willing to help out through some pointers.

- Do follow up, but not daily. And please, try not to reach us through 5 different communication channels! We do check our emails very often. Sometimes, we do have a week or two worth of backlog on emails so it can take some time to reply everyone. Try not to resend your pitch deck over every social media platform, please!

- Keep expectations low - fundraising is really hard! It is a marathon and not a sprint. Keep your morale strong, keep reaching out. There will be times when you depend on the funding but it ends up in a flop after months of negotiations. It happens a lot. However, do make sure you work on the above 3 validation steps. Keeping your business strong fundamentally is the most important factor. Fundraising is secondary to actually working on your Startup.

- Be flexible with terms and keep an open mind. Understand what the terms mean, and try not to reject things right off the bat. Then compare the terms with other investors and get back to them later. This keeps your investor relations warm, and hopefully your negotiations alive. Most deals break down because of the valuation for example. It could be as simple as meeting in the middle.

- Raise fast, move on. Do not spend too much time fundraising. Keep the business growing fast - and focus on that. Fundraising sucks up too much energy and time, and spending too much time on it hurts your results. Results which you need for fundraising!

- Get inexperienced investors to be led by more experienced ones. They can be dangerous and take up a lot of time. Their inexperienced advisors are probably worse at Startup funding matters, so get them to follow another investor that knows what to do.

- Do not take rejection personally - take it as an opportunity to improve on your weaknesses. Admitting and improving oneself only shows the true strength of a person. Do not get demoralised either. The chances of rejection in Startup fundraising is extremely high against Startups - so in a way, rejection is very normal.