Venture capital saw significant growth in 2021 and early 2022, but it did not see the same level of growth in ESG considerations as other investment areas. This presents a significant opportunity for growth in social venture capital in the coming years as investors become more interested in aligning their financial goals with their values and positively impacting society.

The industry is starting to move in this direction, with more firms and sectors focusing on social and environmental impact. Many venture capital firms are now collaborating to improve their practices and support diversity and other critical missions. Additionally, more firms are hiring directors of sustainability and other professionals to steer investments and initiatives in ESG directions.

As investors become more conscious of the impact of their investments and as more companies take steps to address environmental, social and governance (ESG) issues, it's likely that we will see more growth in social venture capital in the coming years. This will provide a growing number of investors with an opportunity to earn financial returns while also making a positive impact on society.

Definition

Social venture capital (SVC) is a type of investment that aims to generate both financial returns and positive social or environmental impact. This approach combines the principles of traditional venture capital with the goal of addressing social and environmental issues. SVC funds typically invest in companies or organizations that are working to solve pressing social or environmental problems, such as poverty, climate change, or access to healthcare. These investments can be made in a variety of sectors, including technology, renewable energy, and education. SVC is gaining popularity as it allows investors to align their financial goals with their values and make a positive impact on the world while earning a return on their investment.

The Importance of Social Venture Capital

Social venture capital is a type of investment capital that is used to finance social enterprises, which are businesses that are established with the primary goal of achieving a social or environmental impact rather than solely maximizing profits. Social venture capital is becoming increasingly important as traditional sources of funding become harder to access, particularly for early-stage businesses.

There is growing awareness of the need to address social and environmental problems, traditional sources of funding becoming less reliable, social enterprises often having a greater impact on society and the environment, as well as being more sustainable than traditional businesses. Social enterprises are motivated by a desire to make a difference rather than maximize profits.

Therefore, social venture capital is an important source of funding for businesses that are making a positive impact on society and the environment and is increasingly being seen as an attractive investment opportunity for those looking to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Role

Social Venture Capital (SVC) is a form of private equity investment that targets companies with a social or environmental goal. SVC firms invest in businesses that strive to produce both financial returns and a positive social or environmental impact. The origins of SVC can be traced back to the venture philanthropy movement in the 1970s. In the early 2000s, a new generation of SVC firms emerged, inspired by the success of socially responsible businesses like Ben & Jerry's and Toms of Maine, which proved that companies with a social or environmental purpose could be profitable and have a global impact.

SVC firms invest in a wide range of organizations, including for-profit companies, social enterprises, and hybrid organizations. They tend to focus on sectors such as education, healthcare, energy, and agriculture and invest in companies at all stages of development, from startups to established businesses.

SVC firms use various financial tools, including debt, equity, and grants, and provide mentorship, networking, and technical assistance to their portfolio companies. SVC has been successful in supporting a number of companies that have a significant impact in their sectors, such as D-Rev, a design firm that creates affordable medical technologies for low-resource settings, and One Acre Fund, which provides smallholder farmers in Africa with financing, training, and market access.

SVC is still a relatively new field and is evolving as the needs of social entrepreneurs change. As more companies enter the space and more capital flows into SVC funds, the industry will continue to grow and mature. SVC is an innovative investment model that enables investors to align their financial goals with their values and make a positive impact on the world while earning a return on their investment.

Types of Social Ventures

Social venture capital (SVC) is a type of impact investing in which financial capital is provided to social ventures with a social or environmental mission. SVC investors seek both a financial return and a positive social or environmental impact, typically through equity investment in for-profit social ventures. SVC investors typically provide patient capital, which means they are willing to accept a lower financial return in exchange for the possibility of a higher social return, and they frequently provide assistance other than financial capital, such as mentorship, access to networks, and expertise.

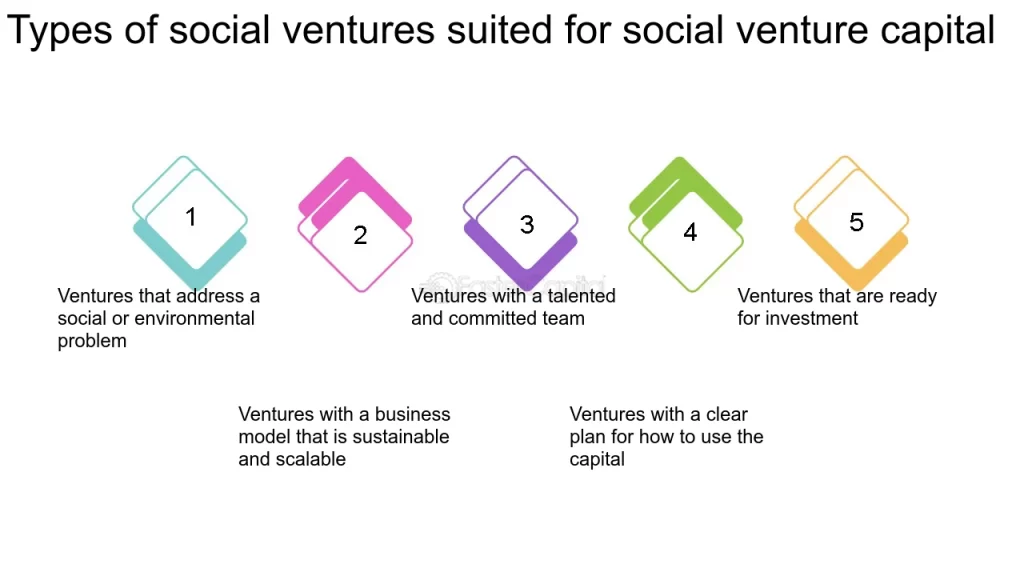

Numerous types of social ventures may be appropriate for SVC, but some common themes include:

These problems can include issues such as poverty, climate change, lack of access to healthcare and education, inequality, and more. Social ventures work towards solving these problems by creating sustainable and scalable solutions, which can have a positive impact on communities and the environment.

Ventures with a business model that is sustainable and scalable

Sustainability and scalability are important factors for social ventures to have a lasting impact. A sustainable business model is one that generates enough revenue to cover its costs and ideally generates a surplus that can be reinvested back into the business. A scalable business model is one that can grow and expand to reach more people or have a greater impact without incurring disproportionate costs. By having a sustainable and scalable business model, the social venture can continue to grow and have a positive impact on society and the environment.

Ventures with a talented and committed team

Having a talented and committed team is crucial for the success of a social venture. Social venture capital (SVC) investors often look for a team that has the passion, skills, and commitment to make the venture successful. A team that is passionate about the social or environmental problem they are trying to solve is more likely to put in the extra effort and determination to make the venture a success. A team with the necessary skills and experience to run and grow the business can help ensure the venture is sustainable and scalable. A committed team that is willing to work hard and make sacrifices to achieve the venture's goals is important for a social venture to be successful.

Ventures with a clear plan for how to use the capital

Having a clear plan for how to use the capital is important for social ventures looking to receive funding from social venture capital (SVC) investors. SVC investors want to see that the social venture has a clear understanding of the social or environmental problem it is trying to solve and how the capital will assist it in achieving its objectives. This includes a detailed financial plan, a clear revenue model, and a projected timeline for achieving specific milestones. The plan should also demonstrate a clear understanding of the market and the venture's target customers, as well as a realistic assessment of the competition and the venture's competitive advantages. Additionally, it should show that the team has a clear vision and mission for the venture and how they plan to scale up and have a greater impact.

Ventures that are ready for investment

Social ventures typically need to have reached a certain stage of development before they are ready for social venture capital (SVC) investment. SVC investors want to see that the venture has a viable product or service, has demonstrated initial traction with customers or users, and has a clear path to profitability. Having a minimum viable product (MVP) or service is important because it shows that the venture has a working prototype or proof of concept that can be tested and validated with customers or users. Initial traction with customers or users is also important, as it demonstrates that there is a market for the product or service and that the venture is on the right track to building a sustainable business. A clear path to profitability is important for SVC investors because it shows that the venture has a viable business model that can generate enough revenue to cover its costs and generate a financial return for the investors.

SVC can be a powerful tool for driving positive social and environmental change. By providing financial capital and support to social ventures, SVC helps these ventures to scale and achieve their impact goals and provides an opportunity for investors to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Challenges

Social venture capital (SVC) is a form of private equity investment that targets companies or organizations that aim to generate financial returns and make a positive social or environmental impact. SVC was created as an alternative to the limitations of traditional philanthropy and impact investing, which often have difficulty scaling and maintaining their impact, by providing funding and expertise to social enterprises to aid in their growth and impact objectives.

However, SVC also has its own set of challenges, such as the high risk of failure for early-stage companies with untested business models, difficulty in attracting top talent as many professionals prefer working for traditional private equity or venture capital firms, and challenges in raising capital as investors may be hesitant to invest due to perceived risks.

Despite these challenges, SVC can potentially drive significant social and environmental change. With the right combination of talent, funding, and expertise, SVC firms can help social enterprises to scale and achieve their impact goals. As more investors look to align their financial goals with their values and make a positive impact, SVC is likely to become a more prominent area of investment.

Social Venture Capital Benefits

Social venture capital (SVC) is a type of impact investing that provides financing and support to early-stage and growth-stage social enterprises. These enterprises are businesses that are established with the primary goal of achieving a social or environmental impact rather than solely maximizing profits. SVC aims to generate both financial return and social impact, unlike traditional philanthropy or government aid.

SVC investors seek to invest in companies that are addressing social and environmental problems in innovative ways, providing much-needed capital to help these companies grow and scale their operations. In addition to financial support, SVC investors also offer their expertise and networks to help social enterprises succeed.

Investors in SVC focus on investing in companies that address social and environmental issues in innovative ways, providing necessary funding for these companies to expand and improve their operations. Along with financial support, SVC investors also offer their expertise and connections to help these social enterprises succeed. SVC has become more popular in recent years, with a growing number of firms and individual investors participating. This type of impact investing has the potential to change the way we solve social and environmental problems by providing sustainable and efficient solutions.

SVC offers a number of potential benefits for social enterprises, such as helping them access the capital they need to grow and scale their operations, providing valuable expertise and networks that can help social enterprises succeed, and creating more sustainable and effective solutions to social and environmental problems. By providing both financial returns and social impact, SVC offers an attractive investment opportunity for those looking to align their financial goals with their values and make a positive impact on the world.

Social Venture Capital Risks

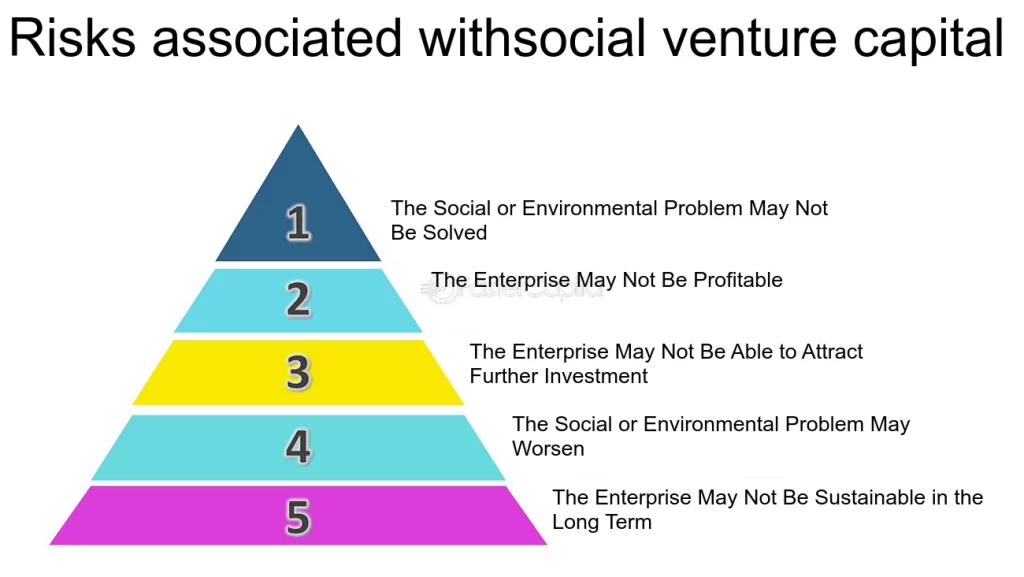

There are risks associated with social venture capital (SVC) investments, just as with any investment. These risks include:

Social venture capital investments carry the risk that the social or environmental problem the venture is trying to solve may not be solved. There are several reasons why this may happen:

- The problem is too big or complex to be solved by the enterprise alone: Some social or environmental problems are so big and complex that they require a coordinated effort from multiple stakeholders. If a social venture is not able to secure the necessary partnerships and collaborations, it may not be able to have a meaningful impact on the problem.

- The enterprise's solution is not effective: Even if a social venture has a good understanding of the problem it's trying to solve, its solution may not be effective in addressing the problem. This could be due to a lack of understanding of the target market, a lack of user engagement, or a lack of scalability.

- The enterprise is not able to scale its solution to reach a large enough number of people or businesses: Even if a social venture has a good solution, it may not be able to reach a large enough number of people or businesses to have a meaningful impact. This could be due to a lack of funding, a lack of partnerships, or a lack of regulatory support.

The enterprise may not be profitable

This could happen for a number of reasons:

- The enterprise is not able to generate enough revenue to cover its costs: Social ventures often have a social or environmental mission that is at odds with maximizing profit. This can make it difficult for the enterprise to generate enough revenue to cover its costs, especially in the early stages of development.

- The enterprise is not able to scale its operations efficiently: Scaling a social venture can be challenging, as the enterprise may not have the necessary resources or infrastructure to expand its operations. This can lead to increased costs and a lack of profitability.

- The enterprise encounters unexpected costs: Social ventures often operate in new or untested markets and may encounter unexpected costs, such as regulatory compliance costs, that can impact profitability.

The enterprise may not be able to attract further investment

This could happen for a number of reasons:

- The enterprise fails to meet milestones or targets set by investors: Social venture capital investors often provide funding in exchange for specific milestones or targets to be met by the enterprise. If the enterprise fails to meet these milestones or targets, it may be difficult to attract further investment.

- The enterprise encounters difficulties scaling its operations: Scaling a social venture can be challenging. If the enterprise encounters difficulties in this process, it may be viewed as a higher-risk investment by potential investors.

- The enterprise faces negative publicity: Negative publicity can hurt an enterprise's reputation and make it more difficult to attract further investment. Negative publicity can come in many forms, such as negative media coverage, legal issues, or regulatory issues.

This could happen for a number of reasons:

- The enterprise's solution is ineffective and makes the problem worse: Even if a social venture has a good understanding of the problem it's trying to solve, its solution may not be effective in addressing the problem and could make it worse. This could be due to a lack of understanding of the target market, a lack of user engagement, or a lack of scalability.

- The enterprise's solution has negative unintended consequences: Even if a social venture's solution effectively addresses the problem, it may have negative unintended consequences. This could be due to a lack of understanding of the broader social or environmental context or a lack of consideration of the potential impacts of the solution on different stakeholders.

The enterprise may not be sustainable in the long-term

This could happen for a number of reasons:

- The enterprise's business model is not sustainable: A social venture may have a good solution to a social or environmental problem, but its business model may not be sustainable in the long term. This could be due to a lack of revenue streams, a lack of scalability, or a lack of profitability.

- The enterprise is too reliant on external funding: Social ventures often rely on external funding, such as grants or social venture capital, to cover their costs. If the enterprise is not able to attract further funding or generate enough revenue to cover its costs, it may not be sustainable in the long term.

- The enterprise is not able to adapt to changing market conditions: Social ventures often operate in new or untested markets, and the market conditions may change over time. If the enterprise is not able to adapt to these changes, it may not be sustainable in the long term.

Investors need to conduct thorough due diligence and have a clear understanding of these risks before making an investment in SVC. This can include assessing the effectiveness of the enterprise's solution, the scalability and sustainability of the enterprise's operations, and the enterprise's ability to attract further investment. Additionally, it's important to consider the long-term sustainability of the enterprise and the potential for negative unintended consequences.

Conclusion

Social venture capital is a form of impact investing that provides financial capital to social ventures with a social or environmental mission. It can provide significant benefits to both investors and social ventures, such as generating financial returns and positive social or environmental impact. However, it also carries a number of risks that should be taken into consideration.

It is critical to understand social venture capital and to educate investors and social ventures on its potential benefits and risks. People and organizations will be able to understand the concept and opportunities of social venture capital if more people and organizations are introduced to them. It may also help to increase the flow of capital to social ventures, which may result in more long-lasting and scalable solutions to societal and environmental issues. As a result, social ventures will be able to grow and develop in the future. It can also aid in the development of the social venture capital ecosystem.

References

VC Funding For Your Startup