Updated: 28/06/2023

Stories abound of startup companies all around the globe, making it big and, in turn, making their investors extremely wealthy, this often makes one wonder how to invest in startups? Investing in a company at the very beginning of its lifecycle can prove to be very profitable. Often with great risk, comes great reward.

If you had invested just $10,000 in Amazon, Dell, Apple, or Microsoft, when they went IPO, you’d be a million dollars richer just from that investment according to the IPO Playbook.

What is a Startup?

Let us quickly run over the basics on how to invest in startups, starting with understanding the definition of a ‘startup’. A startup refers to a company in the first stages of operations. Startups are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. These companies generally start with high costs and limited revenue, which is why they look for capital from a variety of sources.

Understanding the components, nature and the business model of a startup before you decide to invest your money and time is important. There are a few special considerations that you need to consider when it comes to startups, this will make you decide when and how to invest in startups.

Location

Startups must decide whether their business is conducted online, in an office or home office, or in a store. The location depends on the product or service being offered. For example, a technology startup selling virtual reality hardware may need a physical storefront to give customers a face-to-face demonstration of the product’s complex features.

In your decision to how to invest in startups, this is important for you to know where the startup plans to operate and what exactly will you be investing your money and time into. Whether it will be based offline or on an online-based platform.

Funding

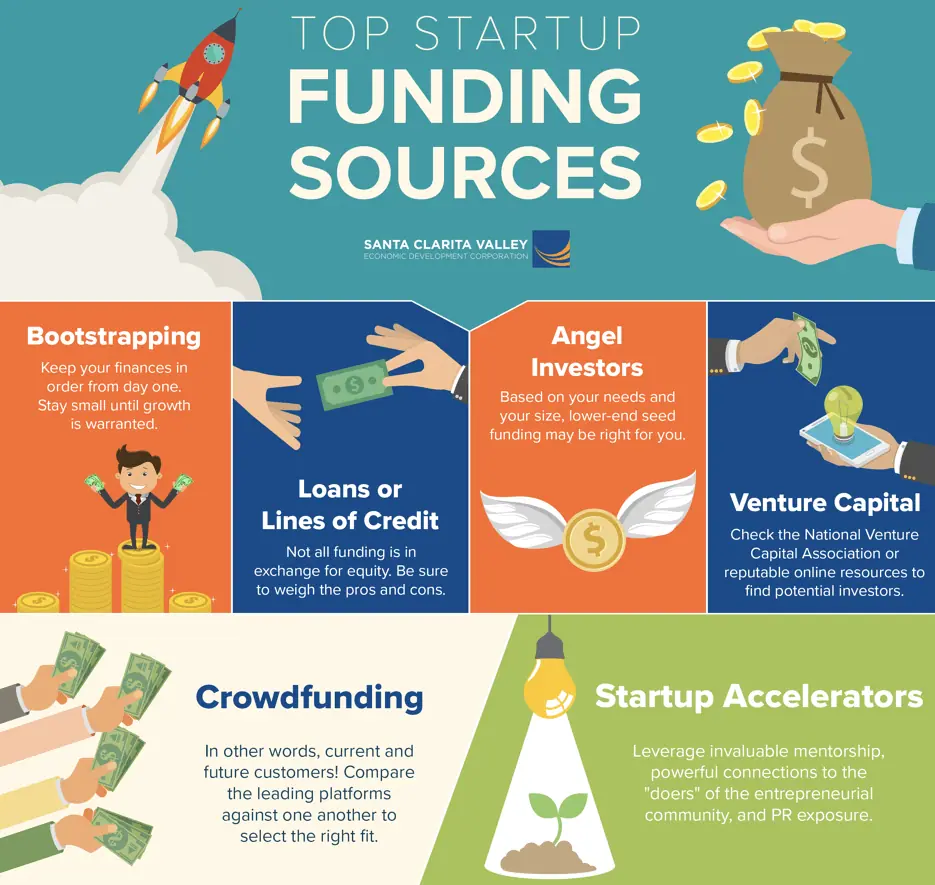

There are many ways that startups are funded according to research by Santa Clarita Valley. In order to understand how to invest in startups, you first need to identify yourself and your source of funding to the startup amongst the following.

Read more on Startup Capital here!

How Are Startups Funded?

- Bootstrapping (self-financing): This refers to funding the startup using personal savings, assets, or revenue generated from the business itself. Bootstrapping allows founders to maintain full ownership and control over their venture. However, it may not always be feasible due to the substantial costs involved, and there is a risk of losing personal funds if the business fails.

- Taking out a loan: Another option is to secure financing by obtaining a loan from a bank or financial institution. This approach enables founders to retain complete ownership of the startup. However, loan repayment, often with interest, begins immediately, and the loan application process can be complex and time-consuming.

- Finding investors: Many startups raise capital by attracting investors who are willing to provide funding in exchange for equity or ownership stake in the company. Venture capital firms, angel investors, and crowdfunding platforms are common sources of investor funding. This approach is particularly popular for startups with high growth potential. Investors provide financial resources, expertise, and networking opportunities to support the startup's development. However, founders may need to give up a portion of their ownership and decision-making authority in return.

How To Invest In Startups

How do you find startups to invest in? There are so many ways online to be able to find startups in your own country to invest in based on the number of finances that you have. The platforms listed below offer a sampling of the avenues available to anyone who wants to invest in a startup with limited funds. While it’s unlikely that you’ll become the next Silicon Valley billionaire, these platforms can help diversify your broader investment portfolio and give you the satisfaction of supporting a young company you believe in. How to find startup companies to invest it? The listed below platforms will be your aid into finding startups.

-

WeFunder. Wefunder has a stated goal of funding more than 20,000 startups by the year 2029. It hopes to do this by accepting investments of as little as $100 at a time. Through Wefunder, an average investor can inject capital into a wide range of companies. At last glance, it was accepting investments into dozens of companies including a fan-owned entertainment company, a vegan marketplace, a dog cancer cure, and a brewing company, answering the question of how to invest in startups and where to find them.

-

Seed Invest. SeedInvest is a crowdfunding platform that allows individuals insight on how to invest in startups, to invest in early-stage companies that have been pre-screened for potential viability. According to SeedInvest, less than 1% of companies that seek funding through the platform are accepted. The company claims it has more than 250,000 investors, with more than 150 companies successfully funded.

When you sign up for an account on SeedInvest, you are presented with a list of companies seeking money. Many companies are open to receiving investments from anyone, but some require large investments and are open only to accredited investors who had an income exceeding $200,000 in each of the past two years. You are provided with a “pre-money valuation” as well as the total value of funds being sought and the amount already raised. Each company has its own minimum investment requirement and a time by which the money needs to be raised.

From the perspective of companies and how to invest in startups, NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd) offers startup support as well as investing in startups.

- NEXEA Angel Investors. NEXEA Investors/Mentors seek investment opportunities in technology startups which can showcase revenue and potential future growth. NEXEA’s Angel Investors are all experienced business owners and/or C-level professionals who are able to provide more than just funding for your startup. We also provide mentorship & support through industry experts & mentors.

The video below answers this question in more details adding to more questions in terms of how to invest in startups specifically.

Startup Investing Process

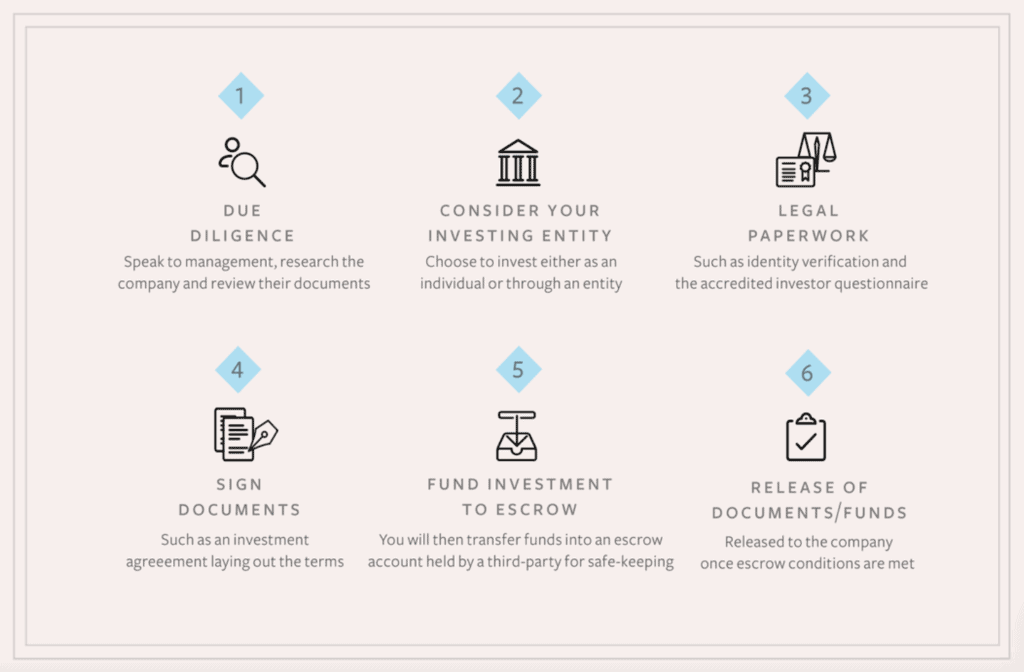

The startup investing process is part of our initial question to “How to Invest in Startups?”. There are a few important steps that need to be done before the investing process begins.

- Preliminary steps: preliminary steps include a business plan – a detailed case for your business, which will include your market research, any traction to date, financial forecasts, the amount of investment being sought, and for what. Pitch Deck – you will present and send this out as reading material, so prepare two versions tailored to your investors.

An executive Summary – this is the written ‘elevator pitch’ for your business. Investors should want to read more but not be left wondering what the core of the business is.

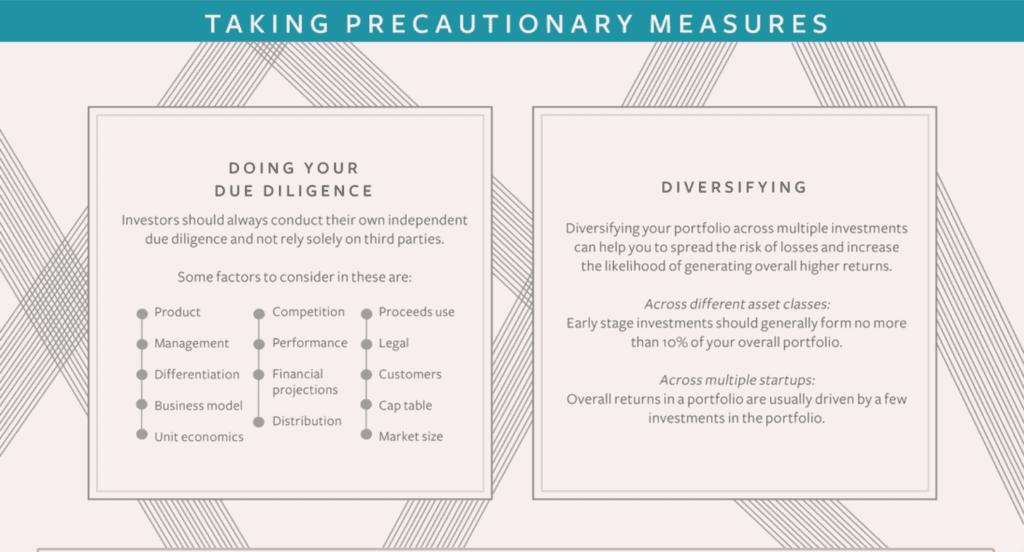

- Due Diligence: Due diligence is the term given to the investigatory work done around a transaction such as investment where the investor conducts detailed research into the financial, corporate and contractual status of your company. Your investors will usually make a preliminary request for you to provide documents which will include: corporate information, budgets, forecasts, key supplier/customer contracts in place, employee-employment contracts, schedule of intellectual property, a schedule of property or leases, a list of equipment owned by the company, details of other investors, shareholders, and bank loans, any existing or future litigation, tax and VAT filings and insurance documentation, and, if applicable, your data protection policies.

- Consider investing entity. Correct legal structure – it is worth noting that you can’t give away shares in your business in exchange for investment monies unless you have a legal entity with shares, i.e. a private limited company. So, if at the moment you are operating as a sole trader, or you haven’t started trading yet but intend to seek investment in the future, you will need to incorporate as a company and transfer all property owned by the ‘business’ into the company name.

- Legal paperwork. Once terms have been agreed and the due diligence has been completed, your (or the investor’s) solicitor will start to prepare the long-form documentation which will implement the funding arrangement. The following documentation will usually be involved: Shareholder’s Agreement or Investment Agreement, Vesting Provisions, Subscription Agreement, Articles of Association etc.

Sign and release of documentation.

Once you have external investors, your accounts and bookkeeping will need to be in immaculate condition and completely up to date. You will probably also have reporting obligations as part of your investment terms so at any given time you may need to report on the financial health of the company.

The process of how to invest in startups does not just start and end with funding only, there is a lot of ‘behind the scenes’ work and effort that goes into finding and investing in the methods of how to invest in startups.

Startup Investments in Malaysia

How to invest in startups in Malaysia? This section will be solving this problem for you if you are an investor or anyone looking for startups to invest in Malaysia.

Joining NEXEA’s Angel Investor Club Malaysia as an angel investor gives you access to at least 1000+ companies per year to bring you about 3-10 quality investments each year. The companies are filtered via our proprietary Startup Fundamentals Methodology. Each startup has to pass our due diligence process, background checks, and investment committee.

NEXEA’s Angels not only teach you how to invest in startups but they also consist of experienced businessmen who own multi-national business, and who have exited via a trade sale, or IPO, or are currently running a listed company. This knowledge is particularly useful for new Investors, we encourage members to share their Investment & Business Experiences. Increase the success rate of startup investment together.

The NEXEA Angel Investors Network is available in Malaysia to sophisticated investors that can support young Entrepreneurs running startups only. This group includes those who are either considered as a High Net Worth Individual or a High-Income Earner.

Also, see our insight on how startups get funding in Malaysia in detail.

Risks and Rewards of Investing in Startups

Is investing in startups a good idea? The answer to how to invest in startups might seem like an easy process, but there are risks and rewards associated with it. According to Investopedia:

- Startup companies are in the idea phase and do not yet have a working product, customer base, or revenue stream.

- Around 90% of startup companies funded will not make it to the initial public offering (IPO).

- Investing in startup companies is a very risky business, but it can be very rewarding if the investments do pay off.

Several high-profile company success stories have proven that putting money into a startup is one of the few great ways to invest and reap high returns. Here’s what motivates investors to put their money into startups:

- Potential high profit. With good planning, startup investments can be very profitable. Pay attention to companies that provide solutions, bring value and develop new trends in the ever-evolving knowledge-based economy. All it takes is an original idea and a solid execution for a startup to become successful. There could be a huge return on your investment if you know the exact skill on how to invest in startups and understand how to grow them.

- Diversification. Startups are an asset class that allows you to explore a different investment channel. Investments are risky and a diverse portfolio means you can minimize the possibilities of taking a big hit during a downturn.

- Buy-out potential. Many startups are bought by large corporations that see them as a potential competitor or want to leverage the technology created by the startup. If the startup you invest in sells at a lucrative price, you’ll enjoy great returns on your investment.

Even with their growth potential, startups are considered high-risk investments since only a small percentage succeeds. Consider these cons before you dig further into how to invest in startups:

- High risk. As fruitful as it may be, you could invest in a company that never succeeds. Startup investments are high-risk and your return on investment depends on the new venture becoming a success. Some markets are extremely competitive or saturated and some business ideas simply don’t work. Take the time to carefully analyze the company you’re thinking about investing in to assess the chances of this startup.

- Personality and attitude of the owner. You are a highly experienced investor with extensive knowledge of how to invest in startups but many angels and VC investors indicate that the personality and drive of the company founders are just as, or even more important than the business idea itself. Founders must have the skill, knowledge, and passion to carry them through periods of growing pains and discouragement.

They also have to be open to advise and constructive feedback from inside and outside the firm. The success of a startup partially depends on how hard the entrepreneur behind the idea is willing to work. To alleviate this risk, get to know the entrepreneur better, find out the history of their past business ventures.

In Conclusion

To conclude, the process of how to invest in startups goes beyond just financing methods. If you feel that startups are a good investment option for you, make sure you, as an investor take the time to look for good business startups and allocate a small percentage of your portfolio to this type of high-risk investment.

Investing in startups is an excellent opportunity for investors to expand their portfolio and contribute to an entrepreneur’s success but investing in a startup is not foolproof. Even though a company may have strong cash flow projections, what looks good on paper may not translate to the real world. Taking the time to execute due diligence when researching a startup investment is something investors can’t afford to skip.

Investopedia

References

Investing in Startups Without Being Wealthy