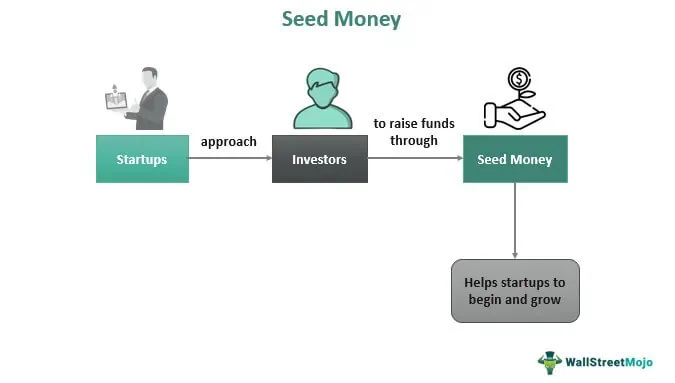

Seed funding is a fundamental resource that can aid a startup in establishing and expanding its business. Unlike traditional bank loans, the terms of the agreement are flexible and can be negotiated to suit the needs of the startup. This type of investment is often favoured by entrepreneurs due to its leniency, and it can come from individual investors, angel investors, or venture capital firms. The funds are generally used to support product development, market research, and early marketing efforts. As a result, seed funding plays a critical role in assisting startups in transforming their innovative ideas into thriving businesses.

The Definition of Seed Money

Seed money, also known as seed capital, is an initial investment made in a startup or early-stage company to help it get off the ground. It is typically provided by angel investors, venture capitalists, or other private investors who are willing to take on higher risk in exchange for potentially higher returns.

Seed money is usually used to finance the early stages of a company's development, such as research and development, product development, market research, and initial marketing efforts. The amount of seed money can vary widely, depending on the needs of the company, but it is typically in the range of tens to hundreds of thousands of dollars.

In exchange for seed money, investors typically receive equity in the company, which means that they own a portion of the company and are entitled to a share of its profits. The amount of equity that investors receive depends on the valuation of the company at the time of the investment.

Seed money is important for startups because it provides the initial funding needed to get the company off the ground and start generating revenue. It also helps to attract additional investment from other sources, such as venture capitalists and institutional investors, who are more likely to invest in a company that has already received seed funding.

Seed money is different from venture capital in that it is typically provided before a business has a proven track record. In contrast, venture capital is often provided to companies that have already demonstrated some level of success.

Seed money plays a critical role in the startup ecosystem by providing entrepreneurs with the capital they need to turn their ideas into successful businesses.

The Importance of Seed Money

Seed money is a vital component for starting a business, especially when you lack the resources to do it on your own. Without seed money, launching a business, developing a product or service, and hiring employees can be quite challenging.

Although seed money may require you to relinquish shares of your company, it is a small sacrifice to make for the potential success of your business. A small stake in a highly profitable company is far better than owning 100 percent of nothing.

Professional angel investors can help entrepreneurs by providing seed money through loans or equity purchases. Smaller transactions typically involve loans, while larger ones involve seed equity. Seed equity transactions can be more intricate, but they are more advantageous for investors as the company grows.

Professional angel investors not only provide seed money, but they can also offer mentorship and guidance, which can help startups flourish. Additionally, securing seed money can increase the chances of attracting additional funding from investors or financial institutions in the future.

Seed money is critical in the early stages of a business's development and can help lay the foundation for future growth and prosperity.

The Works of Seed Money

Seed money works by providing initial capital to new businesses or startups in their early stages of development. It is typically provided by angel investors, venture capitalists, or crowdfunding platforms and is used to cover expenses like product development, marketing, legal fees, and staffing.

The amount of seed funding provided is usually negotiated between the startup and the investor and can vary widely depending on the size of the investment and the expectations of the investor. In exchange for seed funding, investors typically receive equity in the company.

Seed funding is often less formal than later-stage investments, with less emphasis on due diligence and a more relaxed approach to valuation. This is because seed investors are taking on a higher level of risk than later-stage investors and are often more interested in the potential of the business and the team behind it than in its current financial performance.

Seed funding is an essential part of a startup's journey as it provides vital initial capital and support. With the help of seed investors, new businesses can establish a foundation and create momentum for future success. Furthermore, seed funding can increase the startup's appeal to potential larger investors as the business grows and proves its potential.

The Reasons of Using Seed Money

There are several situations where using seed money may be beneficial:

- Insufficient assets: Many aspiring business owners don't have the personal savings or assets to fund their startup on their own, which is where seed money can help.

- Accelerate growth: Seed money can provide the capital needed to hire additional staff, invest in marketing, and ramp up production in order to grow the business more quickly.

- Reduce personal risk: By securing seed money from investors, you can reduce your personal financial risk and limit your exposure to potential losses.

- Avoid overextending personal credit: Seed money can be a way to avoid taking on too much debt or putting personal credit at risk.

- Strategic advice: Seed investors often have experience in the industry and can provide valuable guidance and support beyond just providing capital.

- Potential for further funding: If an investor takes ownership of the business and provides additional funds, this can help the business to continue growing and scaling.

The Reasons of Not Using Seed Money

There are also some situations where using seed money may not be the best option:

- Preserve equity: By avoiding seed money, you can maintain full ownership of your business and avoid diluting your equity.

- Avoid debt payments: Seed money typically involves equity financing, which means you don't have to worry about making regular debt payments that can impact your cash flow.

- Avoid disputes: If seeking seed money from friends or family members, it can be difficult to navigate the personal relationships involved, which can sometimes lead to disputes over money.

- Reduce compliance costs: If you don't take on outside investment, you may be able to avoid some of the regulatory compliance costs associated with taking on investors.

- Investors may demand a premium: Because seed money is typically high-risk, investors may demand a premium in exchange for their investment, which could be more expensive than other forms of financing.

- Avoid sharing ownership or management: If you don't take on outside investment, you can maintain full control of the company and avoid sharing ownership or management with another investor.

Options of Seed Money

There are several options available to obtain seed money:

- Bootstrapping: This method involves using personal funds to make an initial investment and fund growth with early profits. It is the least expensive and most expensive form of funding. Some successful companies like Facebook have used bootstrapping to get started.

- Debt: Debt financing may come in the form of bank loans or personal loans from friends and family. Angel investors and venture capitalists may also provide loans instead of equity investments.

- Equity: Selling ownership shares in a company (e.g., stock) is known as equity financing. The investor receives a portion of ownership, future profits, and possibly voting rights.

- Convertible securities: Convertible securities can change from one form to another. For example, convertible debt may later become shares of equity based on preset conditions, such as if the loan is not repaid quickly enough or if the contract allows for conversion to equity.

- Crowdfunding: Crowdfunding platforms like Kickstarter and Indiegogo can be used to raise seed money. With the JOBS Act, companies can offer equity shares to investors rather than just product discounts.

- Corporate seed funding: Some major companies like Google and FedEx provide seed funding to promising startups that could potentially be acquired in the future.

- Government Grants: Some governments offer grants to startups in certain industries, such as technology or green energy. These grants don't have to be repaid and can be a good option for startups that qualify.

- Incubators and Accelerators: These organizations provide seed money, mentorship, and resources to startups in exchange for equity. They can help startups grow quickly and provide access to valuable networks.

- Friends and Family: While this option comes with risks, it can also be a good way to get seed money quickly and without the strings attached that come with institutional investors. It's important to have clear agreements and communication to avoid potential conflicts.

The Mistakes of Seeking Seed Money

When seeking seed money, there are some common mistakes that should be avoided:

Violating SEC requirements

Startups should be aware of and follow SEC regulations when seeking seed money to avoid any legal repercussions. Publicly advertising that a startup is seeking investors may be considered a form of solicitation, which can trigger SEC requirements for public offerings. Seeking guidance from legal professionals and adhering to the regulations set by the SEC is necessary to prevent any legal infringements when looking for seed funding. Ensuring compliance with these regulations is essential to steer clear of any legal complications.

Offering equity in a crowdfunding campaign

Equity crowdfunding is a way for startups to raise capital by selling equity or shares in their company to a large number of investors, typically through an online platform. This allows startups to reach a wider pool of potential investors than traditional fundraising methods like venture capital or angel investing. However, offering equity in a crowdfunding campaign is subject to certain regulations and requirements under the JOBS Act. Startups should be aware of the regulations and requirements involved in equity crowdfunding before offering equity or profit-sharing in a crowdfunding campaign. They should seek legal and financial advice to ensure compliance with these regulations and to minimize any potential risks.

Giving up too much equity

While it can be tempting to give up a large percentage of equity in order to secure the funding needed to launch or grow the business, it can leave the company with insufficient equity for future financing rounds. As the company grows and requires additional funding, investors in later financing rounds will expect to receive a certain percentage of equity in exchange for their investment. If the company has already given up a large percentage of equity in earlier rounds, there may not be enough left to satisfy these later investors' demands. This can lead to difficulties in securing future funding or negotiating favourable terms for that funding. It can also result in the original founders and management team being diluted to the point where they no longer have significant control over the company.

Taking on too much debt

Debt can be a useful tool for financing growth and expansion. Taking on too much debt can lead to financial difficulties if the startup's cash flows cannot support the debt obligations. Startups should be cautious when taking on debt and carefully consider the amount of debt they can afford to service based on their current and projected cash flows. They should also consider the cost of servicing the debt, including interest payments and fees, and factor this into their financial projections. Startups should have a plan for managing their debt, including a strategy for paying off the debt over time. This may involve negotiating more favourable terms with lenders, refinancing the debt, or increasing revenue and profitability to service the debt more effectively.

By avoiding these mistakes, entrepreneurs can increase their chances of success when seeking seed money.

Conclusion

Seed money is a vital source of funding for startups and early-stage businesses, providing them with the initial capital needed to establish their operations and develop their products or services. Without this initial injection of capital, many innovative ideas would not be able to take off and become successful businesses. Seed money helps to create a foundation for future growth, enabling startups to attract additional investment and expand their operations. While there are inherent risks associated with investing in early-stage companies, the potential for high returns makes seed capital an attractive option for investors who are willing to take on a higher level of risk. As such, seed money remains a critical component of the entrepreneurial ecosystem, driving innovation and fueling the growth of new businesses.

References