Updated: 29/06/2023

Startup capital simplified; It’s the money you raise in order to start your business and get it to the point where your businesses generate enough cash to be self-funding. Startup capital may be provided by venture capitalists, angel investors, banks, or other financial institutions and is often a large sum of money that covers any or all of the company's major initial costs such as inventory, licenses, office space, and product development.

Another alternative name for startup capital may also be startup funding. Lack of capital and funding for startups is one of the major reasons that inhibits people from trying out and taking the risk of starting a business. It's the fear of running out of cash.

"I knew that if I failed, I wouldn't regret that. But I knew the one thing I might regret is not trying"

Jeff Bezos, Amazon Founder And CEO

Check out the list of some of the most successful startups in Malaysia here!

What Is Startup Capital and How Does It Work?

Young and budding companies that are just in the development phase are called startups. These companies are founded by one or more people who generally want to develop a product or service and bring it to market. Raising money is one of the first things that a startup needs to do. This financing is what most people refer to as startup capital.

How Does Startup Capital Work?

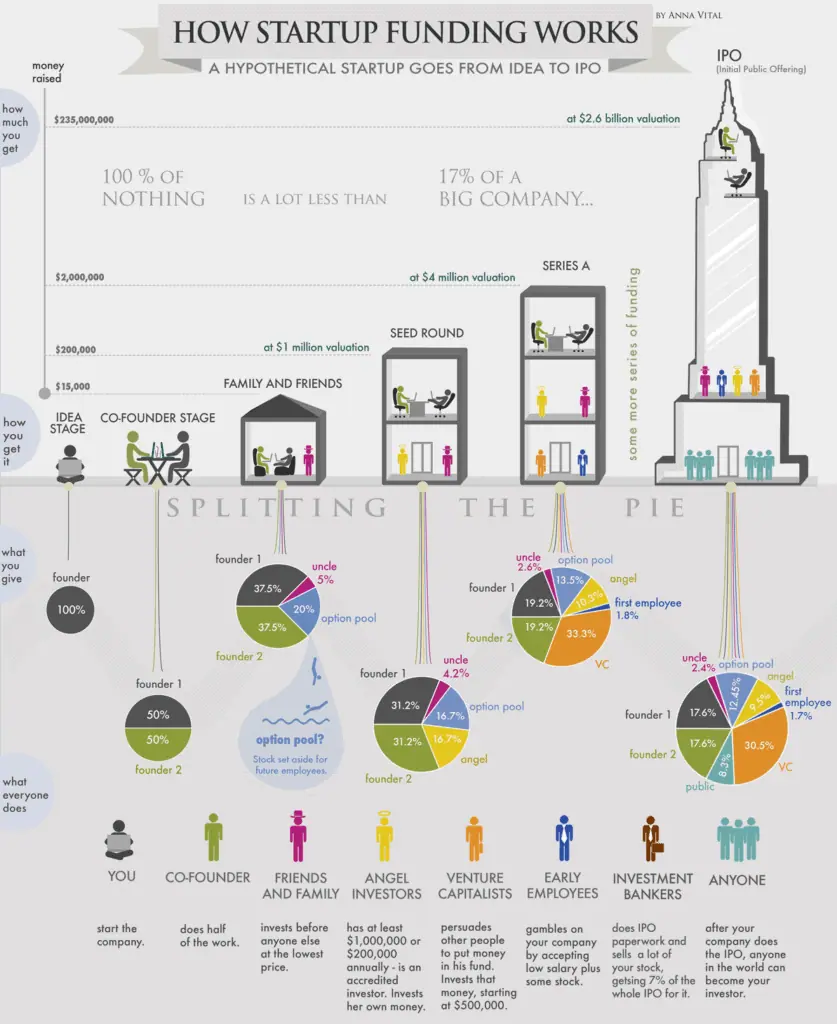

You do not always require funding to begin a startup, the opposite of funding is known as ‘bootstrapping’, that is the process of funding a startup through your own savings. Every time you get funding, you give up a piece of your company. The more funding you get, the more company you give up. That ‘piece of company’ is ‘equity.’ Everyone you give it to becomes a co-owner of your company.

Let’s take a hypothetical scenario to give you an insight into the process that starts from an idea and carries on to the funding stage. Given here is the example of a startup that will get about $15,000 from family and friends, about $200,000 from an angel investor three months later, and about $2 Million from a VC another six months later. If all goes well.

First is the ‘idea stage‘. Out of the many ideas you have had, you finally decide on one. The moment you started working, you started creating value. That value will translate into equity later, but since you own 100% of it now, and you are the only person in your still unregistered company, you are not even thinking about equity yet.

The next stage includes developing a physical prototype of the idea that you are planning. You know you could really use another person’s skills. So you start to look for a co-founder. But you can’t pay them any money (and if you could, they would become an employee, not a co-founder), so you offer equity in exchange for work (sweat equity.) But how much equity should you give? At this point, your startup is worth very less and you also realize that they will do half of the work, they should get the same as you – 50%.

Next stage requires you to understand the fact that your startup won’t go any further unless you have startup capital or funding. So who can you take money from?

- Family and Friends. Even if your family and friends are not as rich as an investor, you can still accept their cash. That is what you decide to do since your co-founder has a rich uncle. You give him 5% of the company in exchange for $15,000 in cash. Now you can afford office workspace and enough to be able to continue building your prototype.

- Accredited Investors. People who either have $1 Million in the bank or make $200,000 annually. They are the “sophisticated investors”. More detail on sources for raising startup capital will be discussed in sections below.

Do I Need Startup Capital?

Raising start-up capital is an important part of developing your own business as an entrepreneur. Once you are committed to the idea of your company you will need funding to get started. It entirely depends on your starting financial position. In order to rent space, buy equipment, develop new products and market or sell your service, you’ll need some form of capital. Startup capital gives you a way to launch your business and provide for those costs until you start bringing in revenue.

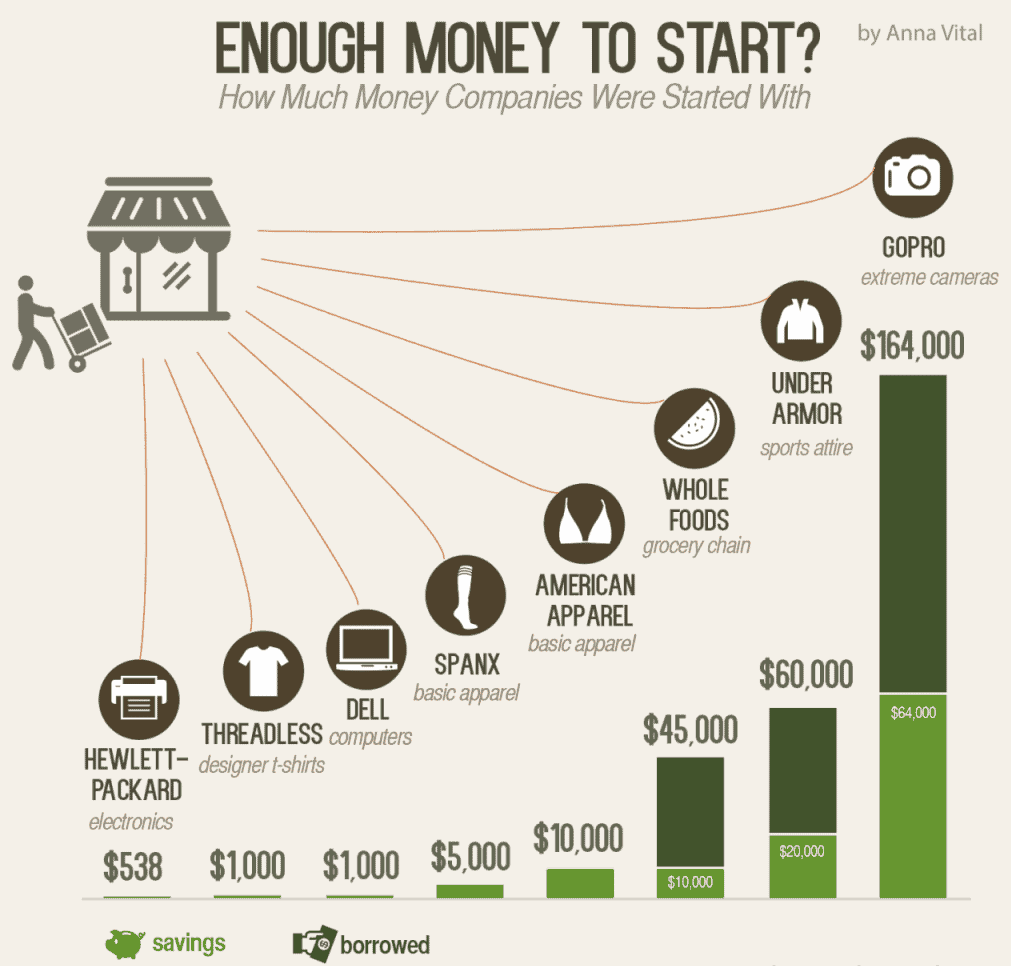

As an entrepreneur, it may be difficult to find the level of financing you need as a startup but there are several options. New businesses most often meet resistance because of the risk involved in their funding. The ability for you to obtain financing is based on your diligence and creativity. Funding comes in many different forms both private and public. Many of the renowned businesses we see today, started with little funding of there own and eventually seek out to potential investors for private or public funding to grow further in the scale of operations.

According to Forbes, there are three important reasons why a new business should seek for startup capital from external sources:

- You are able to scale wider more quickly. When you use bootstrapped money or small loans here and there, you will eventually be able to launch. In the meantime, though, a competitor could come out of nowhere and beat you to market. The traditionally slower forms of financing could mean a missed opportunity for your startup. This would be the correct time to look for sources to raise startup capital.

The larger amounts of funding, combined with a greater chance of additional funding in the future, make raising capital for your startup a smart choice

- You gain credibility. When a venture capitalist is willing to give you a substantial amount of funding, it shows that they see the potential in your startup to succeed, deliver something compelling to the market and provide value to its target audience.

This outward display of approval by a venture capitalist builds instant credibility with stakeholders. Often, funding from venture capitalists is covered in the media, so more people will see that a reputable investor believes in your startup. Not only do you get the startup capital you require, but you could also get incredible media coverage.

- You gain experience and support. When you raise capital for your startup, you get more than just financial backing. That outlay of cash comes with extensive resources, business expertise and instant growth in your network. As a new entrepreneur, you may not be able to reach such an extensive base of resources due to limited experience.

It becomes much more than just raising startup capital. These resources can include legal and tax services and access to research. The investor relationship can also lead to introductions to those in their network. Those connections can provide further opportunities for your startup, including talent acquisition, potential customers and more.

Sources To Raise Startup Capital

As of lately, there are various ways a startup can raise funding and capital for further growth. These methods either include using your own savings, taking a loan from friends and family if the amount is small or looking out for successful angel investors and venture capitalist if the amount required is more than what friends and family can help into. These sources are discussed in detail below with their benefits and drawbacks.

-

Bootstrapping. Provided that your business isn’t operating in an industry that requires lots of startup capital, like manufacturing or transportation, you can potentially fund your own venture through your savings. Investing some of your own money will usually make investors and lenders more willing to partner with you down the line.

Advantages of using your own funds are that startup capital can easily be accessed, you are your own boss and you get to decide how much you choose to invest. Since you are the sole owner and investor at this point, there is little or no bureaucratic obstacles or conflict of interests.

However, a drawback to this approach would be that bootstrapping doesn’t work for large businesses; it only works for small-scale enterprises

-

Friends and Family. Raising capital through friends and family is a viable option for many. According to the Global Entrepreneurship Monitor, 5% of US adults have invested in a company started by someone they know. It is advised that you ideally select a friend or family member with solid business skills. You should be able to narrow your list down to friends or family who have faith that you will succeed, who understand your plans, and who are clear about the risks.

This method requires you to pay them back at your own disposal and at the time at the agreed-upon rate (if any).

-

Angel Investor. Angel investors are people with a huge amount of capital and are willing to invest it on over the edge business ideas. Angel investors can be a good source of capital for your business. First, you must have a solid business plan put together and a great pitch ready. You have to capture their attention with enthusiasm and promising data points about your company’s current situation and future potential.

Benefits of using an angel investor are not just for the funding, but the additional expertise, advice and support they bring along based on their years of experience in the given industry. They are willing to take risks on a business idea as they anticipate a heavy return on investment from your startup.

But a drawback to this approach may be that angel investors provide lower investment capital to business ideas compared to venture capitalists. However, venture capitalists may not be keen on investing in startups as they prefer more solid established companies.

Your next question might be how or where to find an angel investor? Check out NEXEA’s Angel Investor’s for Startups.

-

Venture Capital. A venture capitalist or VC is an investor who either provides capital to startup ventures or supports small companies that wish to expand but do not have access to equities markets.

Venture capitalists look for a strong management team, a large potential market and a unique product or service with a strong competitive advantage. They also look for opportunities in industries that they are familiar with. If you are looking for venture capital financing, you have come to the right place! Click here to learn more about VCs and apply for venture capital financing from NEXEA Group Sdn Bhd (Formerly known as NEXEA Angels Sdn Bhd).

-

Business Incubators and Accelerators. Businesses that are just starting out can access funds provided by business incubators and accelerators. Business incubators or investor startup studios bring in early-stage external startups and help them grow by providing them with expertise. There are slight differences that separate the terms “business incubators and accelerator”.

Business incubators basically nurture business while accelerators fast-track businesses. This is beneficial because business owners receive mentorship from their investors and connections can be made with other startups so there is a huge scope of learning. However, if during the months of this program, commitments are lacking by either of the parties, the startup can quickly fall into decline.

-

Crowdfunding. Crowdfunding has become a novel method of financing, utilizing numerous small investors to fund a specific project. Several platforms exist to facilitate a multitude of successful fundraising campaigns.

Entrepreneurs benefit from crowdfunding in a distinctive way. They can secure funds without relinquishing any ownership stake in their company. Instead, many crowdfunding platforms operate on a rewards-based model, where backers receive incentives such as discounted products or unique experiences in return for their financial contribution.

See NEXEA’s Startup Incubator and Startup Accelerator for all your startup business needs.

Employing the tactics in this guide can greatly increase the chance of survival of your startup. Bootstrapping among other funding sources outlined in this guide is the best way to kick off your business campaign.

However, to truly stay competitive in the market, you must always interchange your funding sources. This provides you with some level of flexibility and over-dependence on one source of funding.

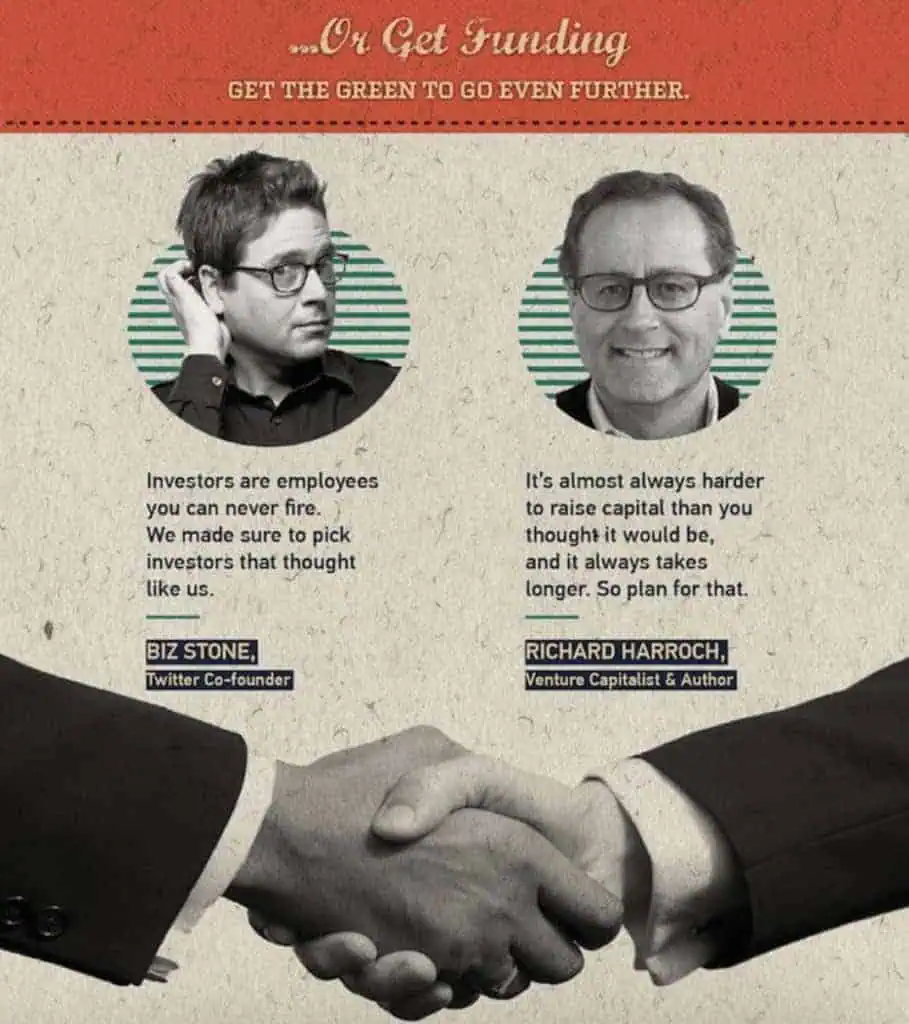

Why is Startup Capital Important: A Lesson Through Testimonials

Surveys show that a lack of capital is one of the most common reasons why small businesses fail, in fact, the second. On the other hand, Apple, Google and Amazon all started as small startups and grew to business giants thanks to funding, they managed to raise enough startup capital from the correct sources at the correct time. The proof is in some of the testimonials mentioned below.

Pixar heard ”no” 45 times before Apple invested in this company, which today is the owner of the 12 animated films listed among the 50 highest-grossing animated films of all time.

Apple Inc. itself has a startup capital raising success story. Founded by Steve Jobs, Steve Wozniak, and Ronald Wayne on April 1, 1976, to develop and sell personal computers. Wayne sold his share of the company to Jobs and Wozniak for $800 in 1977. The company received initial funding of $250,000 from Mike Markkula, a multimillionaire investor. In the first 5 years, the company saw an average growth rate of 700% with revenues getting doubled every four months. Apple is the first U.S. company that is valued at over $700 billion.

eBay, originally called AuctionWeb was founded by a French-born Iranian American computer programmer Pierre Omidyar in his living room in September 1995. It was meant to be a marketplace for the sale of goods and services for individuals. One of the very first items sold on it was a broken laser printer for $14.83. eBay was simply a side hobby for Omidyar until he was asked to upgrade his account by his ISP due to the high volume of traffic it received. In 1997, the company received $6.7 million in startup capital from the venture capital firm Benchmark Capital. The company went public in 1998. Currently, the company is projecting revenues of around $16.05 billion.

Final Thoughts

Raising startup capital is an important part of developing your own business as an entrepreneur. Once you are committed to the idea of your company you will need funding to get started. As an entrepreneur, it may be difficult to find the level of financing you need as a startup but there are several options. There are several options available in today’s business world to be able to fund your startup and take it further. All it takes is a strong business idea, commitment and a leap of faith by the entrepreneur!

As a summary, the video below provides summaries of everything you need to know about the process of startup capital.

References