How they started

Who is Lazada? What is the Lazada business model?

Lazada started their journey in the South-East Asian market back in 2012. Their target was to establish a business model similar to Amazon’s e-commerce, and taking advantage of the company’s weak presence in the region. Now after only 6 years, they have achieved what they set out for, and much more than that.

Timeline

- 2012 – Website soft launch in Malaysia, Thailand, Indonesia, Philippines & Vietnam.

- 2014 – Launched in Singapore. Marketplace platform accounted for more than 65% of overall sales.

- 2014 – Net operating loss of $152.5 million on net revenue of $154.3 million. 38% of GMV.

- 2015 – Customer preference of physical stores became a big challenge for growth.

- 2015 – GMV above $1 billion.

- 2016 – Recorded a total of $1.36 billion in annual GMV.

- 2016 – Alibaba announced the intention of gaining controlling interest with an investment of $1 billion.

- 2017 – Alibaba Group increased investment by another $1 billion, raising stakes from 51% to 83%

- 2017 – 12.12 Sale alone generated $250 million GMV.

- 2018 – Alibaba Group invested another $2 billion and replaced the CEO.

For online retailers, a key metric is growth in Gross Merchandise Value (GMV) the sales value of products sold. In only 3 years, Lazada achieved the GMV of $1 billion and is now the largest shopping platform in Southeast Asia.

So, how do they do it?

Marketplace

Marketplace platform played the most important role in Lazada’s early growth. In August 2013 Lazada officially launched its marketplace in all the countries it was operating in.

“Lazada launches e-commerce marketplace, takes on Rakuten”

The marketplace platform’s success was so apparent that in 2014 it accounted for more than 65% of Lazada’s overall sales.

The marketplace platform is like a virtual land where sellers can open their online stores.

Though it does not charge the sellers/stores anything equivalent to rent, Lazada does take commissions for the services provided.

When there is a successful transaction, Lazada takes a 0.5% to 12% commission from Official Stores, Certified Stores and brands based on the product category and a 2% payment fee.

However, starting from 1 July 2018 Lazada started the 0% commission charge policy ONLY for Marketplace Sellers. This created an environment where sellers/stores will find it difficult to lose money, making appealing to many more sellers to use their service.

Lazada also allocates dedicated accounts managers to educate merchants on e-commerce-best practices and advise on further growth potential.

The target outranking share bid strategy allows companies to raise or lower their bids up to a specified maximum cost-per-click with the objective of “outranking” those of others.

In other words, to help their ads show above other domains’ ads on search results pages, or better yet, to show when others’ ads don't.

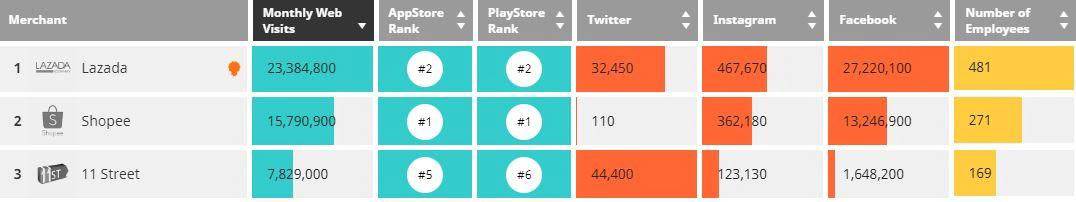

Source: iPrice Insights

As a result, their traffic increased by more than 30% and ad impression share grew by 50%.

Lazada eLogistics

If goods are not delivered to customers on a timely basis and on such a large scale, that e-commerce business is bound to fail.

Lazada works with third-party contractors to develop its own logistics service Lazada eLogistics (LeL) to address the logistics environment challenges in the diverse and fast-growing South East Asia market. LeL’s major innovation resides in their unique network and operating model- an ecosystem of logistics partners along with modern technology and modular infrastructure.

LeL’s other highlights include,

- 72-hour cross-border delivery solution for main metros in SEA

- The Digital Free Trade Zone in Malaysia

- The first fully automated sortation center network in 5 markets.

- Plans to add 5-6 more warehouses next year.

- Has over 100 partners in delivery, cross-border logistics.

- Experimenting with delivery modes, offline pick-up.

Time-Sensitive Pricing

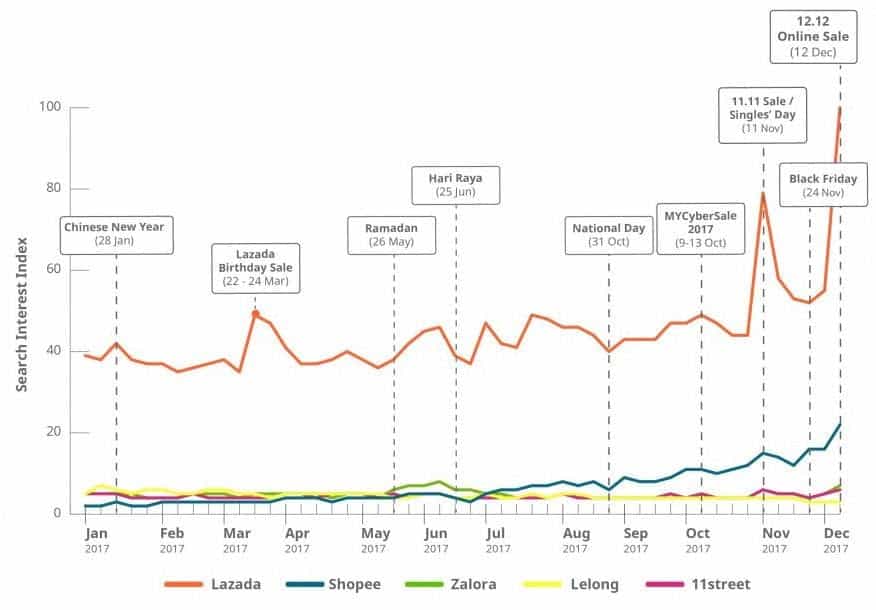

This is Lazada’s most popular and successful sales strategy. Time-sensitive pricing is when the price of a product or service expires after a specific period, commonly known as sales events. 11.11 Single’s Day sale and 12.12 Year-End sale are Lazada’s biggest and most sought-after sales events.

Source: iPrice Insights

Lazada has been consistently ahead of their competitors on both of these sales events. In 2017, Lazada group generated GMV $250 million alone from their 12.12 sale. It broke their previous record of GMV $123 million during 11.11 sale in 2016.

Also, during Lazada’s big sales events such as 11.11 or 12.12 sales, they have a new marketing policy named “Slash it”. Under this feature, users can invite their friends, family or anyone to slash the price of the featured product by a certain percentage. The more people you invite to slash the price for you, the higher the discount you get, as high as up to 90%. This way you’re doing the marketing for Lazada by letting more people know about the sale while enjoying a big discount!

Price Cut up to 90%

Cheaper price is always more tempting to the customers! When asked about how Lazada is able to bring down prices by more than 90 percent, Co-founder and CEO of Lazada Philippines Inanc Balci said:

“Through our own funding, we make subsidies in certain products. Brands make subsidies in certain products because their marketing costs are much lower when they sell online, as they don’t have to open all these stores and employ more people. So, the cost base of our brands and merchants is much lower. We also contribute ourselves. Together, the prices have become unbelievably low,”

Payment Options, Protection, and Rebates

In today’s world, the convenience of making fast and secure payments means a great deal to the customers.

This helps to boost sales and convenience over other competitors.

Lazada has a variety of payment options available, ranging from old school cash on delivery, to credit/debit card, PayPal, Alipay (Lazada’s HelloPay rebranded), 7eleven and even Instalment through a bank.

Their Payment Protection covers unauthorized transactions made using your Lazada account credentials, with terms and conditions applied. Lazada promotes their e-wallet by offering a rebate for payments made using their e-wallet.

Mall page advertisements

Lazada allows the sellers to promote their products on specific product pages (i.e. promoting eyeliner on makeup listings, promoting cupboards on furniture listings). This a part of Lazada's revenue model.

This will cost extra money, as according to Lazada’s policy, successful advertising (counted by the number of clicks achieved via the promotion of the product) will be charged to the seller via deduction from the seller’s Lazada pay-out.

To ensure the system is not abused, an algorithm to detect fraud was implemented.

This system can be used by everyone, but specific brands/ bigger companies with higher budget benefits from this system more. When looking into the Lazada store, brands such as Huawei, Xiaomi, Lego, and other big names can be seen on the homepage (where everyone passes through).

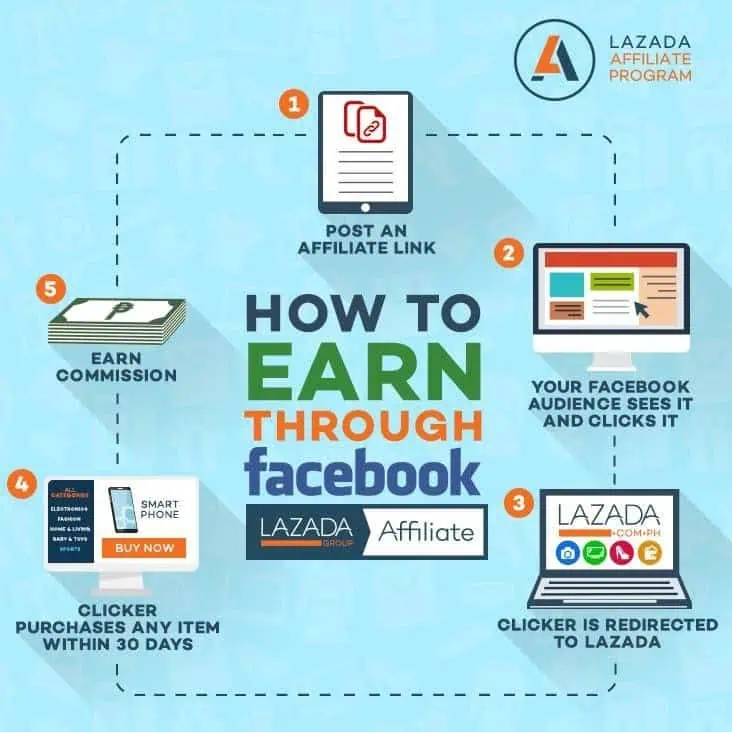

Affiliates

Getting an increasingly large number of users/customers is one of the main goals of any ecommerce business. In this case, Lazada has their affiliation program.

Under this program, users who promote specific products that Lazada have provided to them will gain a 10% commission if the transaction of said product is successful.

This can be done through any means, through social media (Youtube, Facebook, Instagram) would usually be the most effective method.

Alibaba

Lazada’s acquisition by Alibaba is one of the major reasons why it managed to sustain a lead against the competitors despite constantly losing money.

Sparring losses show Lazada desperately needed Alibaba investment

Alibaba acquired Lazada back in 2016 with $1 billion and today their investment in the company stands at $4 billion. After the acquisition, the company moved from a B2C (business to consumer) model to a B2B2C (business to business to consumer) model.

This means third-party sellers can get direct access to consumers via the Lazada Marketplace function. Lazada also expanded to allow consumers in Southeast Asia to purchase items from Taobao. It is a Chinese online shopping website owned by Alibaba. It mostly carries mass-market products.

Lazada changed their CEO for the second time in the year 2018, by replacing (one of the) Alibaba founder Lucy Peng with Pierre Poignant.

Poignant has led the development and expansion of Lazada’s logistics footprint in Southeast Asia. However, Lucy Peng will remain the executive chairwoman.

It is quite clear that Lazada is in an advantageous position against the competitors due to Alibaba’s deep pockets and e-commerce experience.

But wait, why are they still losing money?

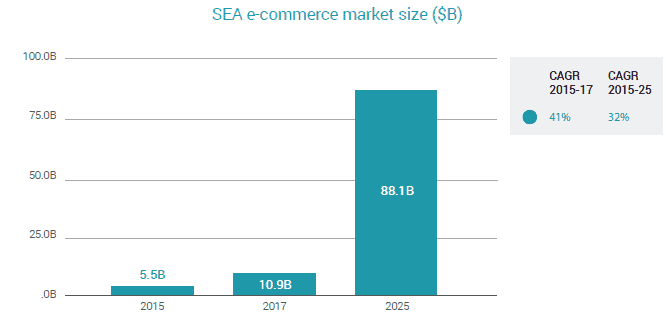

Source: Google-Temasek

The SEA e-commerce market is ruled over by big names like Lazada and Shopee.

According to Google-Temasek’s eConomy Spotlight: SEA 2017, the compound annual growth rate of the SEA e-commerce market from 2015-2017 was 43%. The market size grew from $5.58 billion to 10.98 billion and expected to be $88.18 billion by 2025.

However, in order to gain market share, these firms have to allocate massive amounts of money on sales and promotion programmes to lure in consumers. This is the major reason behind their massive losses.

The excuse is that burning money is a way to quickly grow the habit of buying online. They believe that subsidising purchases will drive more trust in online purchases.

They are still increasing this effort to grow the market further - to drive more offline purchases online.

On top of that, competitors are bringing in pressure to continue burning money - otherwise they will lose market share.

Is this the right strategy? How many Startups can afford to burn money similarly to how they do it? Is it even sustainable?

Only time can tell.

References

https://www.digitalnewsasia.com/sizzle-fizzle/lazada-launches-ecommerce-marketplace-takes-on-rakuten

https://support.google.com/google-ads/answer/6268616?hl=en

http://manilastandard.net/business/corporate/252544/lazada-boss-shares-strategy-for-low-prices-.html

https://iprice.my/insights/mapofecommerce/en/

https://iprice.my/trends/insights/e-commerce-rewind-2017-a-year-end-review/

https://www.blog.google/documents/16/Google-Temasek_e-Conomy_SEA_Spotlight_2017.pdf

Learn more about real business models